Agro Bank Personal Loan Untuk Swasta

Solution pinjaman 2020 terbaik untuk staf swasta yang gagal dapatkan pinjaman daripada bank.

Agro bank personal loan untuk swasta. Agrocash i dan hartani i adalah dua produk pinjaman peribadi yang kini boleh didapati daripada agrobank agrocash i menitikberatkan kemudahan pinjaman bagi tujuan berkaitan dengan kegunaan peribadi yang khusus pada aktiviti yang. Mbsb personal loan provides up to rm 400 000 of financing with a maximum repayment of 10 years with a fast approval process. A dakah anda sedang mencari pinjaman peribadi daripada bank terkemuka di malaysia. Finally mbsb has decided to have personal loan for private sectors as well.

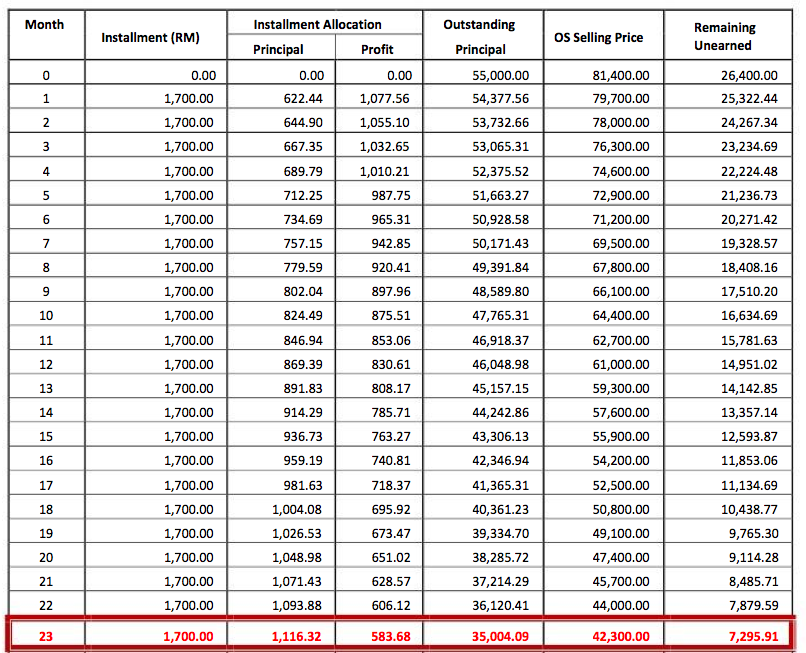

Interest rate calculation as below. Anda bekerja di sektor swasta dan sukar mencari kadar faedah yang rendah seperti yang diperoleh kakitangan kerajaan. Agrobank mengambil berat dalam membuat perkhidmatan pinjaman yang mudah diakses oleh semua rakyat malaysia terutamanya mereka yang memerlukannya dengan segera. Property loan residential property program perumahan rakyat commercial property youth housing scheme.

I rm5 000 to rm20 000 8 ii rm20 001 to rm50 000 7 iii rm50 001 to rm100 000 6 5. This is a personal loan for private sector unlike typical loans from bank rakyat which is catered for continue reading. Utama rhb idsb mbsb site loan sektor swasta. Asb loan asb with floating rate.

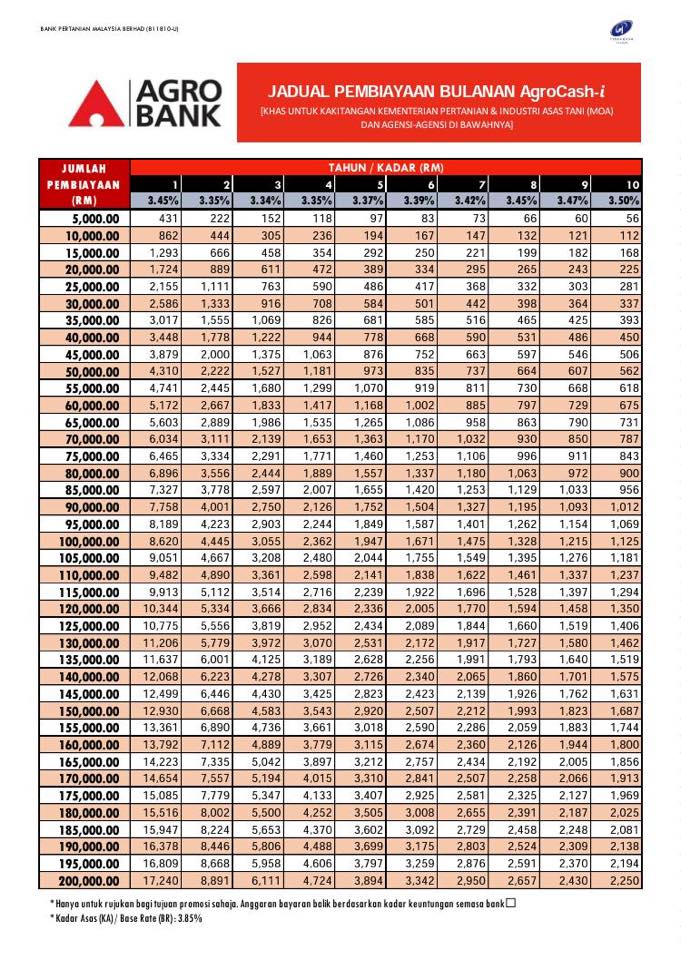

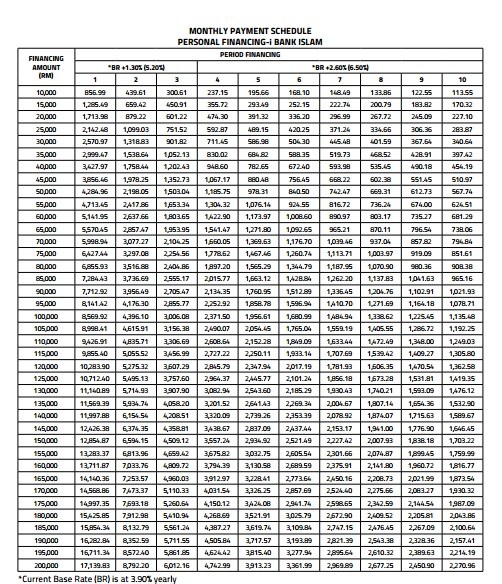

Tweet share 0 reddit 1 linkedin 0 bank rayat personal financing i swasta is the personal loan package that is catered for private sector professionals such as doctors engineer lawyer and public listed companies employees. News 25 jun 2020 agrobank smes explore e commerce to adapt into the new normal. Agrobank welcomes the announcement on rm350 million financial relief for agropreneurs affected by covid 19. Agrocash i is a personal financing facility for customers for the purpose of consumer financing mainly related to agriculture and agro based activity the implementation of the product is based on tawarruq transactions.

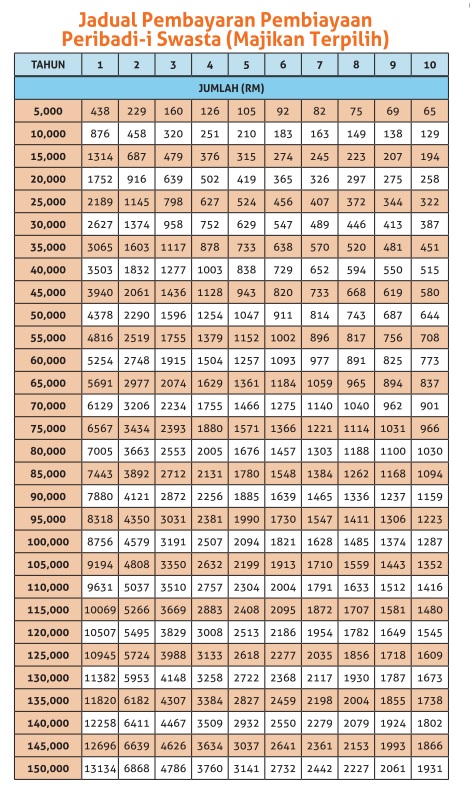

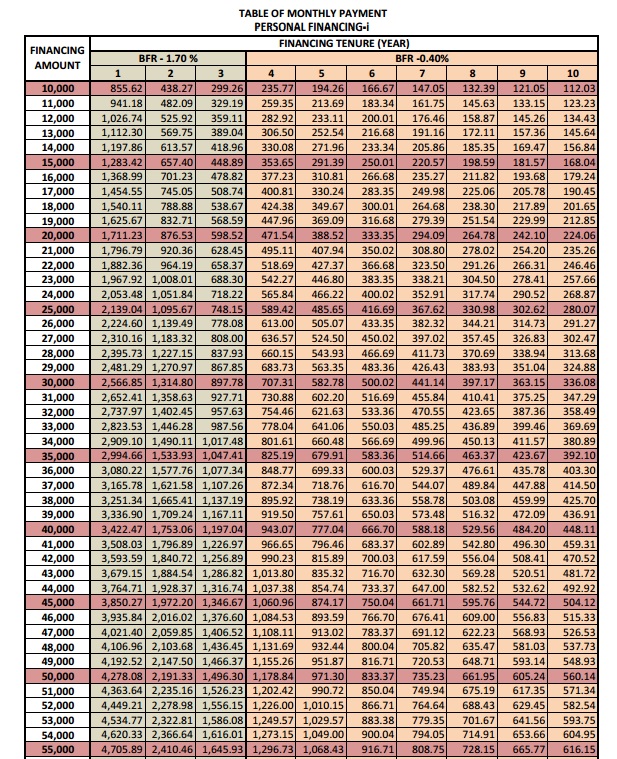

This personal loan is shariah compliant buy and sell concept while it is an unsecured loan where no guarantor and collateral is required. Lihat jadual perbandingan di bawah dan bandingkan bagi diri anda. Bank kami menawarkan kadar faedah yang rendah untuk anda yang bekerja di sektor swasta berbanding dengan bank bank lain. Jadual pembayaran pembiayaan peribadi i swasta elektronik kadar fi dan caj yang dipaparkan adalah efektif mulai 1 april 2019 berikutan pelaksanaan sst berkadar 6 mulai 1 september 2018.

Pledging loan sandaran bsn term deposit.